The $1 Billion Skimming Problem You Didn’t See Coming

Imagine swiping your card at a gas station, only to find your bank account emptied days later. That’s the reality for thousands of Americans falling victim to credit card skimming a sneaky, high-tech theft method that’s exploding nationwide.

The U.S. Secret Service recently cracked down on skimming rings in Operation Potomac, recovering 27 devices that could’ve stolen $7.2 million. But with criminals getting craftier, here’s how you can outsmart them.

What Is a Skimmer And How Does It Work?

A skimmer is a clandestine device attached to ATMs, gas pumps, or checkout terminals. When you insert your card, it secretly copies your magnetic stripe data, which criminals later encode onto blank cards. Some even use hidden cameras to record your PIN.

Why is skimming so rampant?

-

Low risk, high reward: Each skimmer can net thieves $300,000.

-

EBT cards are prime targets: Criminals steal from vulnerable families relying on government aid.

-

Gas stations & ATMs are hotspots: Isolated locations with less surveillance make them easy targets.

Operation Potomac: A Wake-Up Call

In early 2025, a multi-agency sting across D.C., Maryland, and Virginia inspected 6,561 payment terminals. The results? 27 skimmers found some hidden inside machines, others disguised as bulky card readers.

“They’re stealing from people who need it most,” says Secret Service Agent Matt McCool. Thieves drain EBT cards meant for groceries, then splurge on luxury goods.

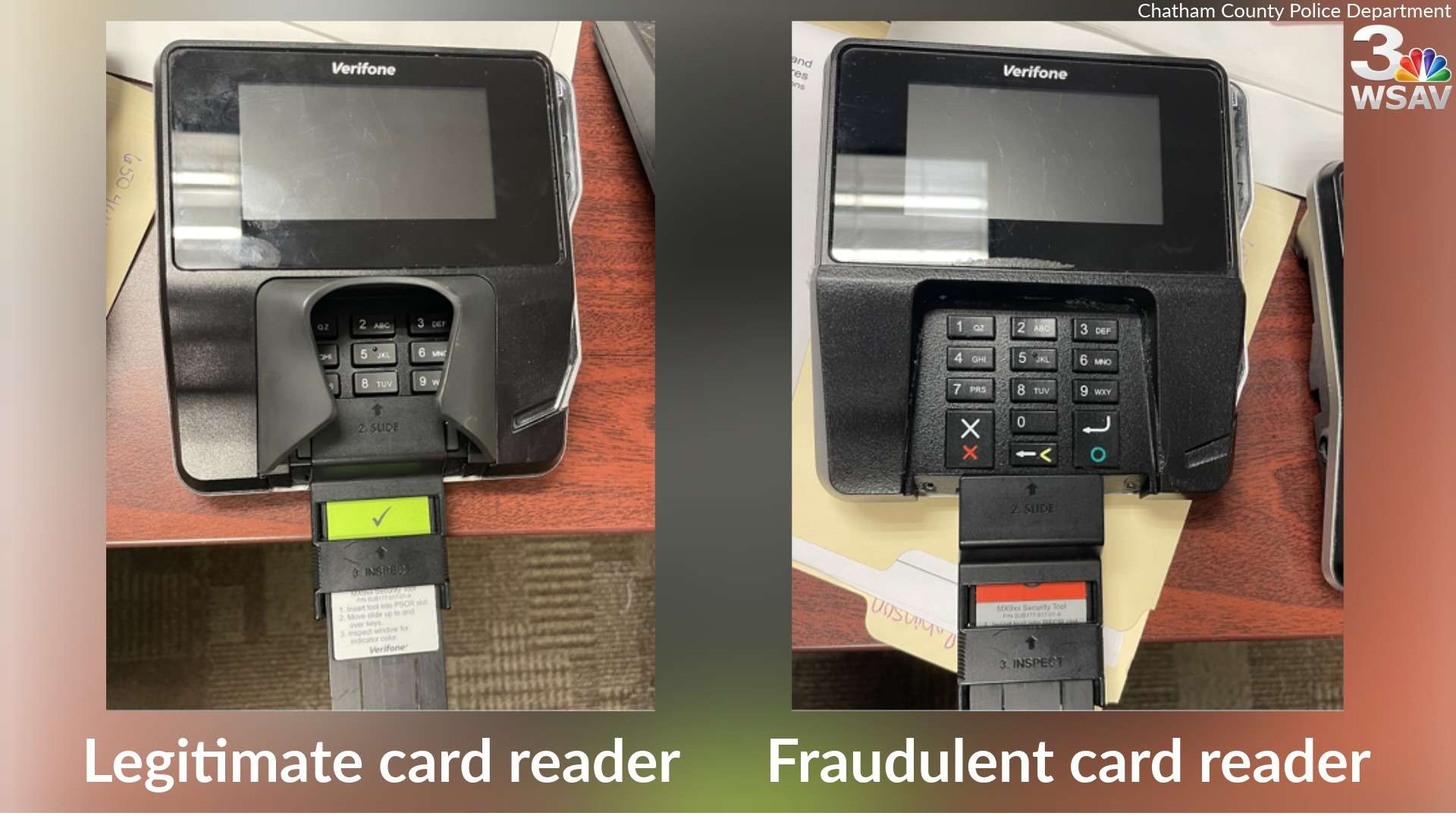

How to Spot a Skimmer (Before You Swipe)

The Secret Service shared five key checks to avoid getting skimmed:

1. The Wiggle Test

Gently tug the card reader and keypad. If anything feels loose, it might be a fake overlay.

2. Look for Odd Shapes

Legitimate card slots are sleek. If the reader looks bulky, convex, or misaligned, it could be a skimmer.

3. Check for Hidden Cameras

Some skimmers use tiny pinhole cameras near the keypad. Shield your hand when entering your PIN.

4. Avoid Standalone ATMs

Machines in dimly lit corners or convenience stores are riskier. Stick to bank-affiliated ATMs with surveillance.

5. Tap Instead of Swiping

Contactless payments (Apple Pay, Google Wallet) bypass the magnetic stripe entirely, making them skimmer-proof.

Why Skimming Is Hard to Stop And What’s Being Done

Despite PCI DSS security standards, criminals keep evolving. New skimmers now use Bluetooth to wirelessly transmit stolen data, eliminating the need to retrieve the device.

Tech to the rescue?

-

Skim Reaper: A special card that detects extra read heads inside compromised machines.

-

EMV chips: Chip cards are harder to clone, but many gas stations still rely on magnetic stripes.

What to Do If You’re a Victim

-

Monitor your accounts daily for unfamiliar charges.

-

Report fraud immediately to your bank and the FTC.

-

Freeze your card if you suspect skimming.

Bottom Line: Stay Alert, Stay Safe

Skimming isn’t going away, but awareness is your best defense. Next time you pay at the pump or an ATM, trust your instincts. If something feels off, walk away.

Your turn: Have you ever spotted a skimmer? Share your story in the comments—you might help someone avoid a financial nightmare.

Why This Matters

With $1 billion lost yearly to skimming, a few seconds of vigilance can save you from weeks of fraud headaches. Stay sharp, spread the word, and always check before you swipe.

Discover more from CyberAwareHub

Subscribe to get the latest posts sent to your email.